Cornerstone Wealth Advisors is an independent financial advisory firm that provides investors with personalized wealth management to help them meet their individual needs and goals. The company is also a Registered Investment Adviser (RIA) with the U.S. Securities and Exchange Commission. Cornerstone Wealth Advisors provides investment advice, asset management, financial planning, and other related services.

Cornerstone Wealth Advisors’ fee model is designed to be transparent and easy to understand. The company offers three different investment models: fixed fee, percentage of assets under management, and a hybrid of the two. The fixed fee model is a flat rate that is charged regardless of the size of the portfolio. The percentage of assets under management model is based on a percentage of the total assets under management with the client. The hybrid model is a combination of the two, with the percentage of assets under management being charged for larger accounts, and the fixed fee charged for smaller accounts.

The fees charged by Cornerstone Wealth Advisors depend on the type of investments and services provided. The company’s fees generally range from 0.50% to 2.00% of the assets under management. The company also offers several specialized services, for which the fees may be higher than the standard fee ranges. For clients with larger accounts, Cornerstone Wealth Advisors may offer a discounted fee.

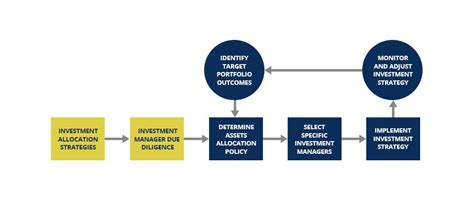

Cornerstone Wealth Advisors offers a range of investment strategies, including long-term growth strategies, income strategies, and portfolio diversification strategies. The company also provides access to a variety of investments, from traditional stocks, bonds, and mutual funds to alternative investments, such as private equity, venture capital, and real estate.

Cornerstone Wealth Advisors strives to provide clients with unbiased advice and personalized service designed to meet individual needs. The company’s focus is to provide quality, objective advice and assistance in making sound financial decisions. Cornerstone Wealth Advisors is committed to helping clients achieve their financial goals.

Understanding Cornerstone Wealth Advisors Fee Model

Cornerstone Wealth Advisors is an independent financial planning firm that offers financial advising services to individuals and businesses. The firm is committed to providing clients with unbiased advice and guidance in order to help them reach their financial goals. Cornerstone Wealth Advisors has a unique fee model that is designed to provide clients with a transparent and cost-effective services.

The Cornerstone Wealth Advisors fee model is based on a percentage of assets under management (AUM). This fee is determined by the total amount of money managed by the firm and is typically in the range of 0.5% to 1.5%. For example, if a client has a portfolio of $200,000, the fee would be 0.5% of that amount, or $1,000.

The fee covers the cost of services such as asset allocation advice, retirement planning, estate planning, tax planning, portfolio analysis, and more. The fee also includes access to advisors who can provide personalized advice to clients. In addition, Cornerstone Wealth Advisors provides clients with a variety of financial tools, such as portfolio modeling, investment reports, and financial calculators, in order to help them make informed decisions about their investments.

In addition to the AUM fee, Cornerstone Wealth Advisors also charges an annual fee. This fee covers the cost of providing services such as portfolio monitoring, asset rebalancing, and performance reporting. The annual fee is typically in the range of $500-$1,500 per year, depending on the size of the portfolio and the level of services provided.

For clients who are looking for a more comprehensive advisory service, Cornerstone Wealth Advisors also offers a customized financial planning package. This package includes a comprehensive financial plan, with a personalized investment strategy, budgeting advice, and advice on retirement planning, estate planning, and tax planning. The cost of this package is based on the complexity of the plan and typically ranges from $2,500-$5,000.

Table 1.

| Fee Type | Cost |

|---|---|

| Assets Under Management | 0.5%-1.5% of assets |

| Annual Fee | $500-$1,500 per year |

| Customized Financial Planning | $2,500-$5,000 |

In conclusion, Cornerstone Wealth Advisors has a fee model that is designed to provide clients with transparent and cost-effective services. The firm offers a variety of services, including asset allocation advice, retirement planning, and customized financial planning, at a variety of price points. Clients can choose the fee structure that best suits their needs and budget.

Exploring Benefits Of Cornerstone Wealth Advisors Fee Model

At Cornerstone Wealth Advisors, we are dedicated to providing our clients with the highest quality of service and advice. We believe that the best advice is only achieved through a comprehensive understanding of each individual’s financial situation, goals, and risk tolerance. Our fee model is designed to ensure that our clients receive the highest quality of service, while also allowing our advisors to focus on the most important aspects of our clients’ financial planning.

The Cornerstone Wealth Advisors fee model is based on an annual fixed-fee basis. This fee is based on the size of the portfolio, the complexity of the financial planning needed, and the level of service required. Our advisors have the flexibility to tailor a plan to the individual needs of each client. We also offer additional services, such as portfolio reviews, tax planning, and estate planning, for an additional fee.

The Cornerstone Wealth Advisors fee model offers several advantages over traditional fee-based advisors. First, our fee structure rewards our advisors for providing superior advice and service. This is because our fees are based on the complexity of the financial planning, which incentivizes our advisors to focus on getting the most out of each client’s financial situation. Second, the fixed-fee structure makes it easier for clients to budget for their financial planning services. Finally, our advisors are able to provide unbiased, independent advice because they have no financial incentive to recommend products or services from any particular vendor.

At Cornerstone Wealth Advisors, our goal is to provide our clients with comprehensive, customized financial planning that is tailored to their individual needs. Our fee model is designed to ensure that our clients receive the highest quality of service, while also providing our advisors with the flexibility to focus on the most important aspects of our clients’ financial planning.

| Service | Price |

|---|---|

| Financial Planning | $500/year |

| Portfolio Review | $150/review |

| Tax Planning | $250/year |

| Estate Planning | $500/year |

Cornerstone Wealth Advisors works with its clients to develop a strategy and fee structure that fits their individual needs. The fee model is based on an hourly rate or an annual retainer.

Yes, there is a minimum fee for Cornerstone Wealth Advisors services. The minimum fee varies based on the services requested.

Yes, there may be additional fees associated with Cornerstone Wealth Advisors services depending on the type of service being provided.

Yes, Cornerstone Wealth Advisors provides advice and guidance on investments and portfolio management.

Cornerstone Wealth Advisors provides advice on financial planning, retirement planning, estate planning, investment planning, and tax planning.

No, Cornerstone Wealth Advisors does not provide advice on insurance products.

Yes, Cornerstone Wealth Advisors offers access to a team of experienced financial advisors.

Yes, Cornerstone Wealth Advisors offers online tools such as portfolio tracking and financial calculators.

Yes, Cornerstone Wealth Advisors offers educational resources such as webinars, podcasts, and newsletters.

Yes, Cornerstone Wealth Advisors has offices in San Francisco, Los Angeles, and New York.